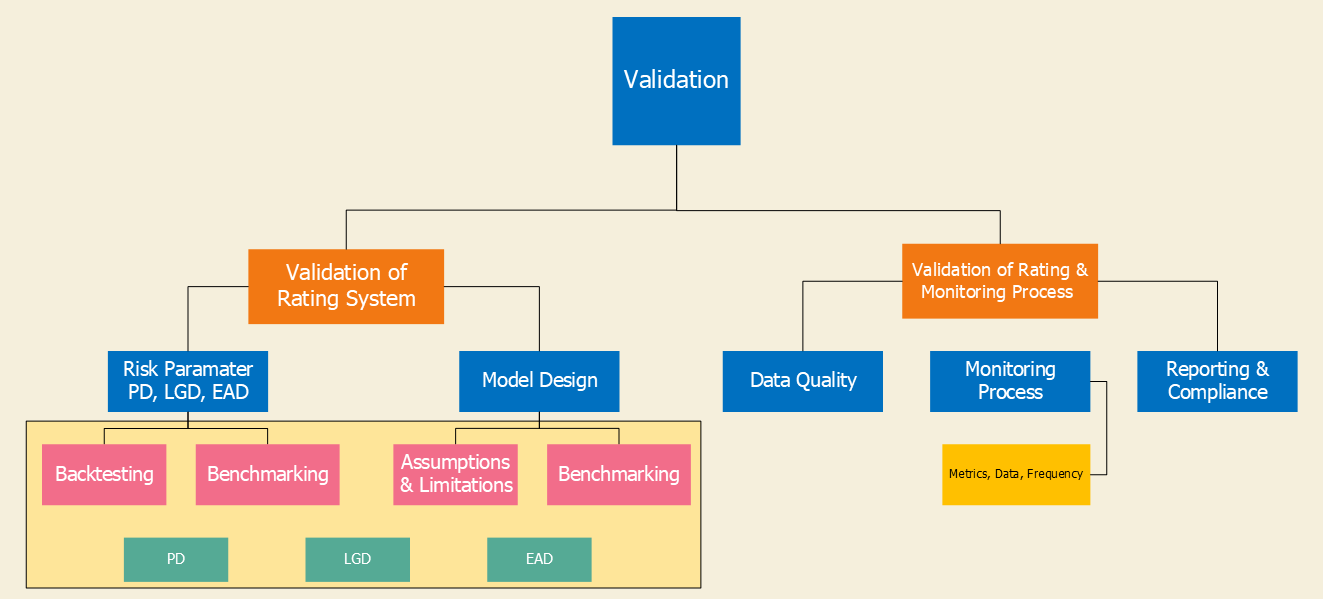

To ensure lnternal Rating Based (IRB) models are adequate and address regulatory requirements, IRB models are subject to a regular validation cycle, with emphasis given to a thorough model backtesting and benchmarking. In addition, validations require testing of conceptual soundness and are commonly supplemented by the outcome of model monitoring and the use of external data sources.

IRB and IFRS 9 credit models deteriorate when models fail to capture emerging risks. Consequently, both Basel IV and IFRS 9 add to a raise in standards expected for model validations. Demonstrating robustness of credit models under stress and ensuring accurate model calibrations continues to deliver critical impacts for provisioning and capital efficiency.

Disclaimer: Data, charts and commentary displayed herein are for information purposes only and do not provide any consulting advice. No information provided in this documentation shall give rise to any liability of Auriscon HK Ltd and Auriscon Ltd.

Our Aproach

is to support or independently carry out validation activities, both according to the timetable of the institutions validaton framwork or ad-hoc based on moment and circumstances. We assist in defining and performing various statistical testing and analyses covering validaiton of risk parameter PD, LGD, EAD and Credit Portfolio models.

Planning & Execution

We support the planning and executing of validation exercises including Compliance and Regulatory Expectations, Emerging Risks, Statistical Testing, Data Governance, Programming, and Report Automation.

Specialisation

Given our specialization in Credit and Model Risk, we can suport with relevant contributions. We are a specialist provider in the field and draw insight from hands-on experience.

Detailed Testing and Risk-Based Approach

We support in identifying latent and emerging risks to higlight detrimental impacts in relation to the validaton subject. Our validation contribution covers qualitative validation and thorough statistical testing to deliver benchmarking and backtesting.

Contact us to request further details on our support.

→ Contact

Causes for Model Risk

| Wrong Model Use | Wrong model usage leading to shortfall in governance. |

| Model Limitations | Model design limitations due to unsuitable methodologies and mismatched assumptions leading to unsuitable model outputs. |

| Data Limitations | Lack of data quallity leading to calibration bias. |

| Machine Learning | Lack of transparency of risk driver used in black-box methods lead to interpretation gaps and heightened Model Risk.. |

The Elements of Validation (selected examples)

tbc

Backtesting at Model Level

- tbc

- tbx.

- tbx

- tbx

We involve our clients throughout the stages beginning from an initial proposal for a suitable analytical model towards interpretation and use of metrics in marketing.

We progress during analysis of data and model building based on agreed terms and targeted outcomes.

At Auriscon Limited have the right expertise.

We can support on-site or by working remotely based on flexible allocations.

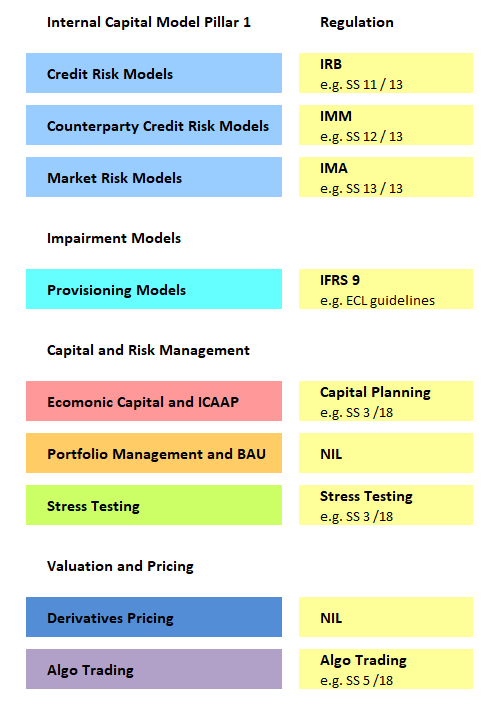

Mapping of Asset Class and Risk Areas to Regulations

Regulators have confirmed that financial institutions must implement a Model Risk Management (MRM) framework. This includes setting up an adequate governance of Models with policy for model life cycle and a periodical follow-up with reviewing and assessments.