We assist in Credit Analytics specializing in the development and validation of Credit Risk models. At Auriscon we draw on multiple model building techniques to ensure our customers in IRB model uses, Portfolio Credit Risk, Stress Testing and IFRS9 have access to specialized support. We have capacity to deliver end-to-end. We support across the stages: conceptualizing, model building, model testing, prototypical coding and documentation.

We too provide expert support model risk reviewing. At Auriscon, we have suitable expertise and we enable knowledge transfer based on in depth industry practice.For further details, feel invited to browse through an outline of supported activities summarized below. For inquiries on support towards a succesful project outcome contact us.

→ Contact

Disclaimer: Data, charts and commentary displayed herein are for information purposes only and do not provide any consulting advice. No information provided in this documentation shall give rise to any liability of Auriscon HK Ltd and Auriscon Ltd.

Our Approach

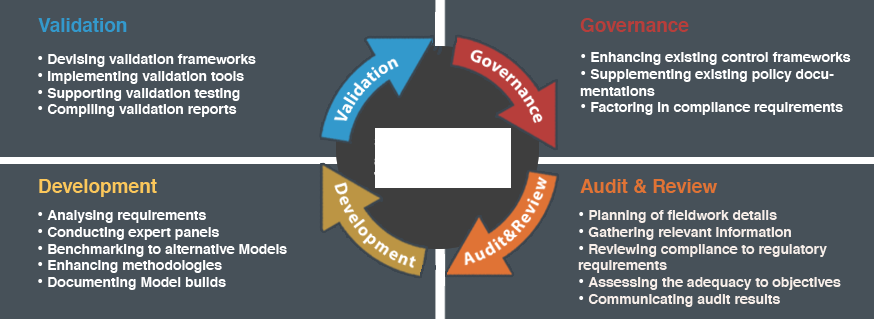

We involve our clients throughout the model development and validation process, beginning from the initial concept proposal and an agreed terms of reference through to the final implementation phase. Team member of Auriscon Limited have the right expertise. We can support on-site or by working remotely based on flexible allocations.

- We confidentially deal with methodological concepts and analytical models.

- We draw on business insights to deliver tailored solutions.

- We advise on industry standards and point to emerging risks.

In Model development projects we ensure objectives are realized in time. We help clients to successfully manoeuvre a challenging regulatory and market environment. Our specialism in Credit Risk ensures that analytical models align to industry practice. We advise on solutions and implement prototypes for boosting model performance.

Our Services in Credit Analytics

CREDIT RISK - MODEL DEVELOPMENT & VALIDATION

Development and validation of Credit Risk Models, covering Basel parameter estimation PD-LGD-EAD, IFRS 9 Expected Credit Loss ECL, Portfolio Credit Risk Models including Default Risk Charge for the Trading Book and Risk-adjusted performance for Credit Lending.

BOOSTING CREDIT MODEL PERFORMANCE

Evaluation and enhancement of credit model performance. Profitability driven Credit Analytics, to enable enhancing Credit Models through accounting for Profitability aspects and measures.

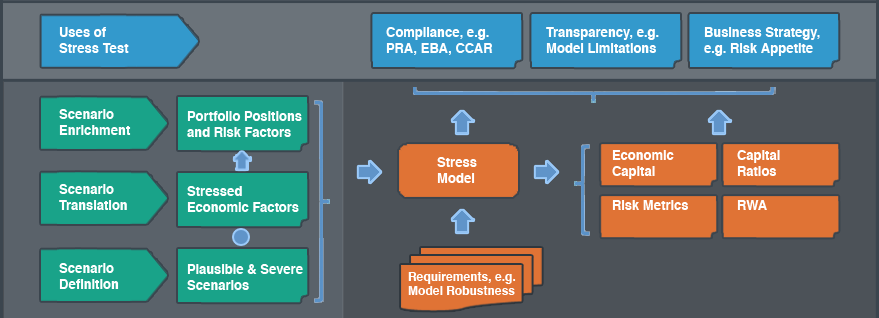

STRESS TESTING

Model concepts and developments covering Scenario Planning, Factor Identification, and Economic Response based on modern methods e.g. Vector Autoregression.

MODEL RISK REVIEW

Review of Model concepts and developments incuding validations, regulatory compliance and model governance. Our support in reviewing model risk and compliance renders a suitable add-on insight.

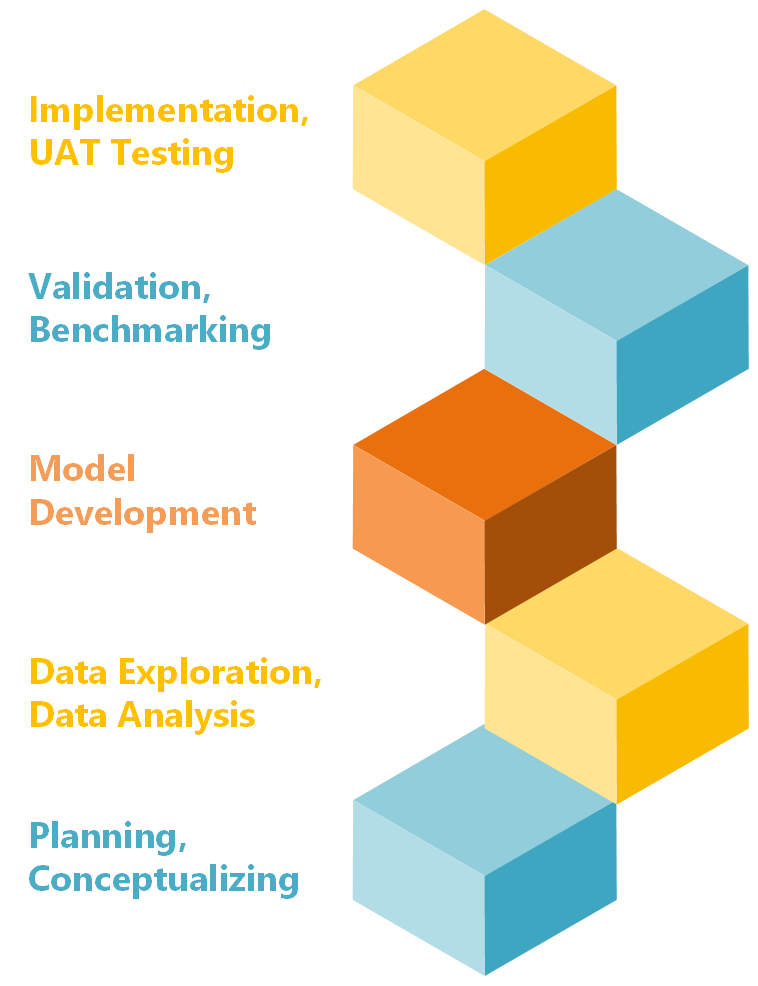

Illustration of our supporting activities

At Auriscon we can support on-site or by working remotely based on flexible allocations. We collaborate effectively with functional teams and stakeholders to assist in attaining the project goal. A few examples of how Auriscon can support your model development or validation projects are shown below for illustration.

OBJECTIVE

HOW

Boosting performance of PD and LGD models and identifying profitability aspects hidden in Credit models.

- Data Sources for alternative credit drivers

- Feature Engineering for better predictors

- Profitability aspects for adding perspective

- Benchmarking w.r.t. model types

| Interpretabiliy | Accuracy | |

| Regression (logistic) | Good | Medium |

| Decision Tree | Very Good | Good |

| Boosted Tree | Poor | Very Good |

| Deep Learning | Poor | Very Good |

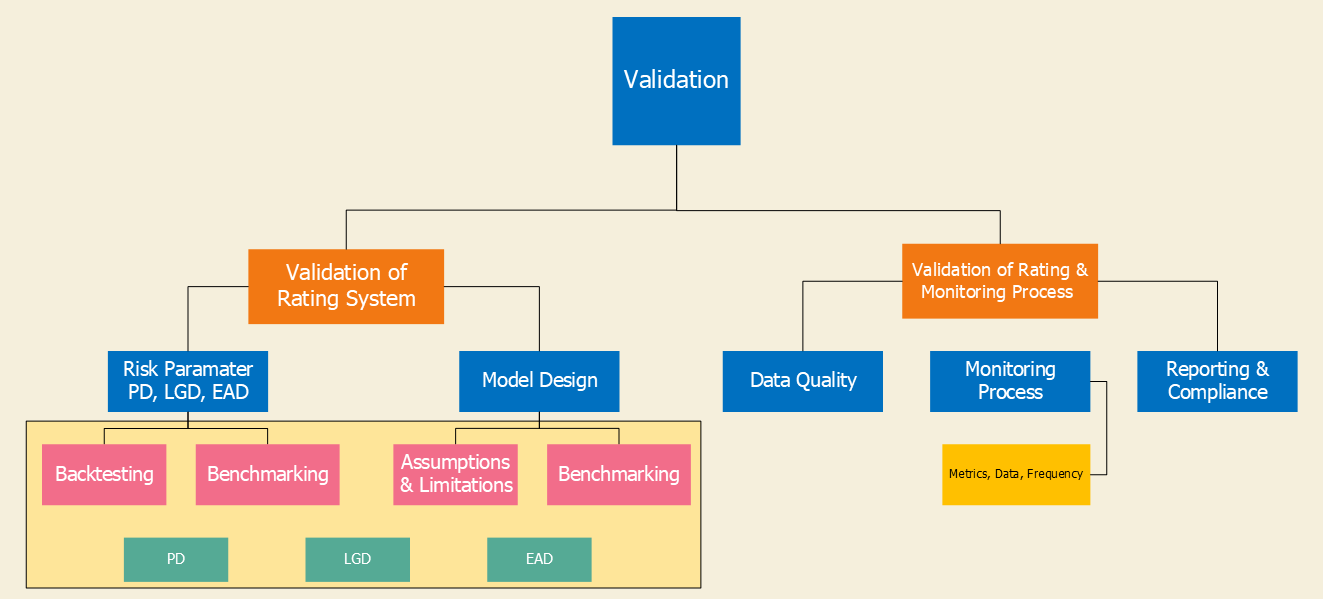

Validating IRB and Scoring Models

Support on initial and regular cycle of PD, LGD, EAD model validations.

Validation testing of credit model predictions (backtesting), performance and stability.

Benchmarking to challenger models.

Feedback on gaps in model monitoring framework and details.

Identifying and quantifiying model risk related to root causes in model design, data, validation gaps, etc.

Elaborating on process ineffeciencies to match risk mitigation solutions to root causes.

Communicating review outcome and writing report on model risk review for internal use.

Detecting

- Model design limitations.

- Data limitations

- Calibration bias leading to alert on inadequate model outputs.

- Shortcomings in validations e.g. identifying overlooked themes and details.

- Gaps in compliance to regulatory requirements e.g. Credit Risk (SS 11/13), Capital & Stress Testing (SS 3/18).

Credit Risk Stress Testing

Development and conceptual planning for Scenario Planning, Factor Identification, Economic Response based on modern methods.

Estimating & Calibrating

Economic Response Model using Vector Autoregression (VAR).

Data Selection

Macro linkages in models used for Economic Responses should be suitably selected.

Credit Portfolio Risk

Relying on Credit Portfolio models should be supported by insightful analytics, tools and data. At Auriscon, we support in deliver exactly this with our assistance.

Examining & Prototyping

- Credit Loss Distributions.

- Segmentation of customer groups.

- Credit Portfolio Vulnerabilities.